Money Supply: M0, M1, M2, M3, M4 | Notes for UPSC

Money Supply

Money supply refers to the total volume of money circulating in an economy at a particular time. It includes cash, coins, and various types of deposits that can be quickly converted into cash. The concept of money supply is crucial in understanding and managing an economy’s monetary policy, inflation, and overall economic health.

Measures of Money Supply

The measures of money supply are categorized into different aggregates, reflecting the liquidity of different financial assets. These aggregates are standardized by central banks, such as the Reserve Bank of India (RBI) in India, or the Federal Reserve in the United States. The definitions and categories can vary from country to country, but they generally follow a similar pattern from the most liquid assets (such as physical currency) to assets that are less easily converted to cash but still considered part of the money supply.

In India

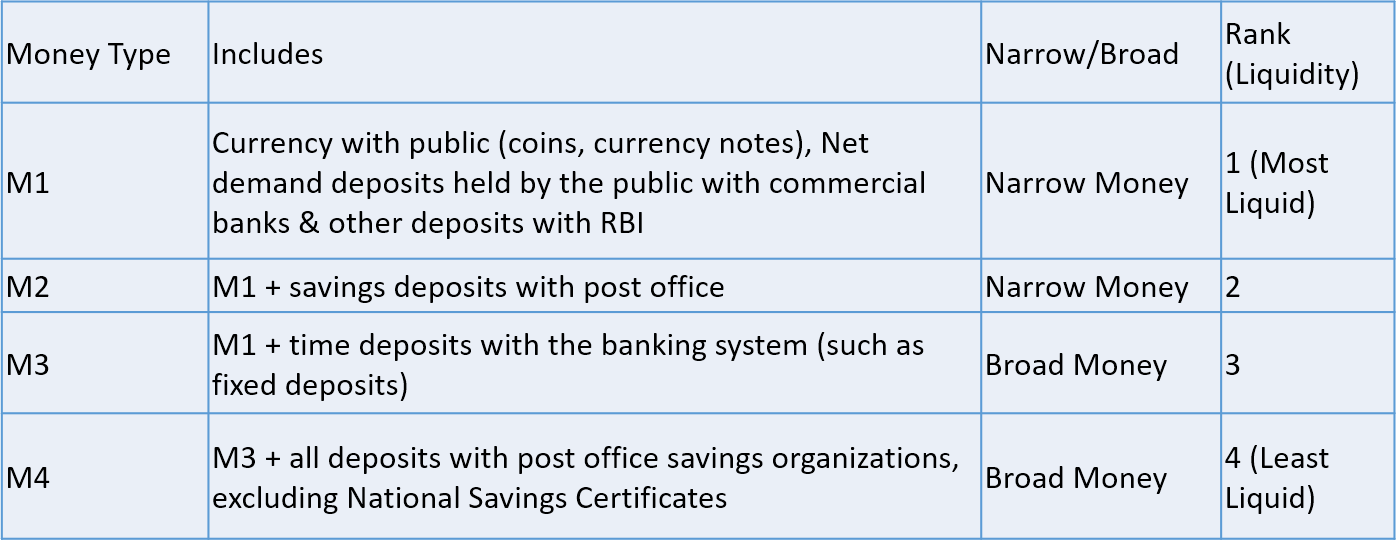

In India, the Reserve Bank of India categorizes money supply into four main aggregates:

M0 (also known as Reserve Money, Monetary Base, or High-Powered Money)

This includes all the physical money in circulation within the economy (notes and coins) plus the banks’ reserves with the RBI. It represents the most liquid form of money.

M1 (Narrow Money)

M1 includes currency with public (coins, currency notes), Net demand deposits held by the public with commercial banks & other deposits with RBI. It is a narrow measure of the money supply that includes the most liquid forms of money.

M2

M2 includes M1 plus savings deposits with post office. This aggregate is more relevant in countries where a significant portion of savings is held in postal savings systems.

M3 (Broad Money)

M3 is a broader measure of the money supply. It includes M1 plus time deposits with the banking system (such as fixed deposits) and other deposits that are not as readily accessible as demand deposits but still part of the overall money supply. This is the most commonly used measure of money supply as it provides a comprehensive view of the money available in the economy for spending and investment. M3 is also known as aggregate monetary resources.

M4

M4 includes M3 plus all deposits with post office savings organizations, excluding National Savings Certificates. This is the broadest measure of money supply and includes all forms of deposits that can be converted into cash and used for transactions.

These measures help central banks, economists, and policymakers analyze the money supply’s impact on inflation, interest rates, and economic growth. By adjusting the money supply, a central bank can influence economic activity, manage inflationary pressures, and stabilize the financial system.